Yesterday Joe Biden unveiled his $1.9 trillion economic recovery plan. The recovery plan includes:

- $1400 stimulus checks

- Additional $400 per week for unemployment through September

- $25 billion for child care centers

- $35 billion for small businesses

- $400 billion for more testing and vaccine rollout

- $350 billion for state and local governments

- $15 minimum wage

- And more

More details and a breakdown of the plan can be found here.

The magnitude of this recovery plan is right and I believe this is an excellent start to helping the economy recover from COVID-19.

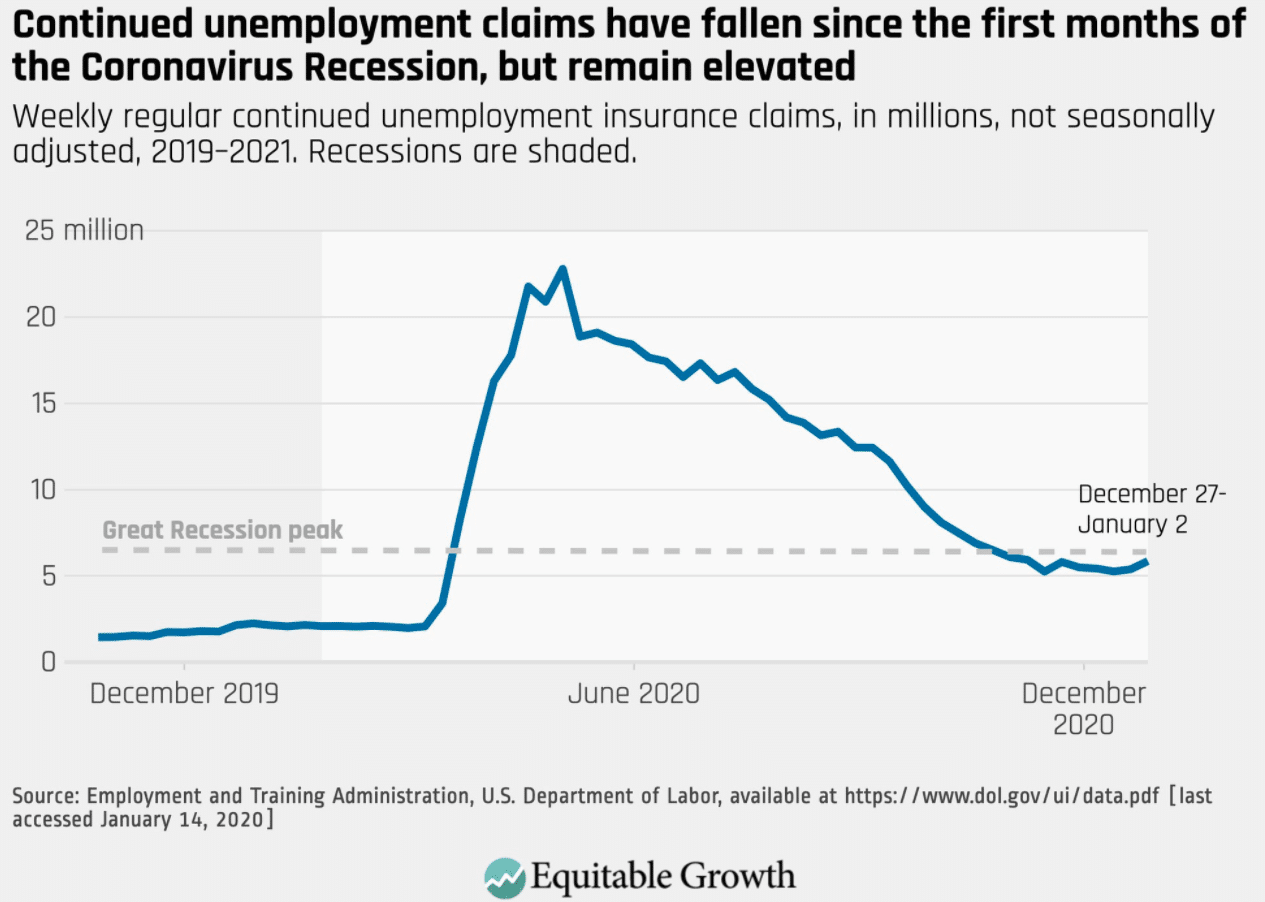

1) Unemployment has been at or above the peak level of the Great Recession since March. The economic recovery has stagnated as COVID-19 has increased during this winter surge. Just opening the economy is not enough; people were not going out to eat and were not spending, even in states that had fewer restrictions. The economy cannot fully open until the virus is under control, this help is needed.

2) The $400 billion for increased testing and vaccine rollout will have a huge return on investment. The faster we get people vaccinated, the faster life can return to normal. I am glad to see this number where it is, it probably could be even higher.

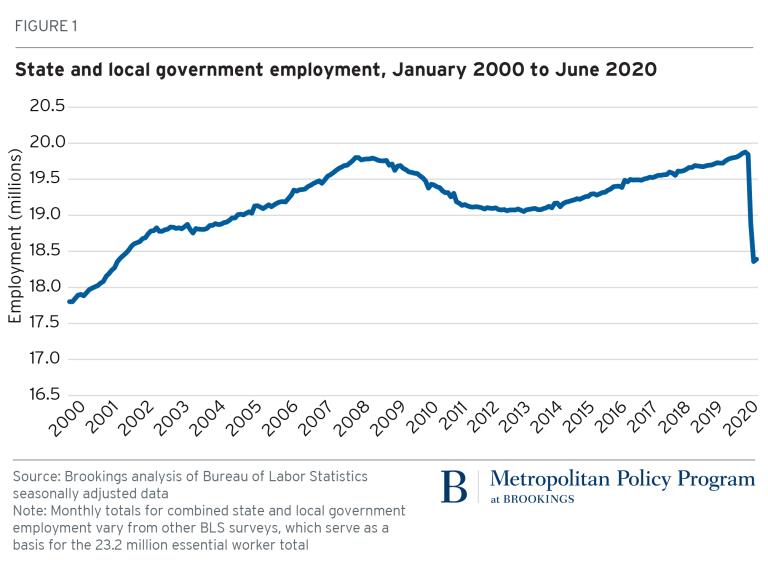

3) $350 billion to state and local governments is very important. There were massive job losses for state and local government employees during the Great Recession, which includes teacher and first responders. It took 10 years to recover those job losses. The amount of job losses during the pandemic is more than 10 million jobs. Without that aid, it could take a very long time to recover those jobs and stagnate the economic recovery. We did not give the right amount of aid to state and local governments during the Great Recession, this is the right move it will help speed up the recovery.

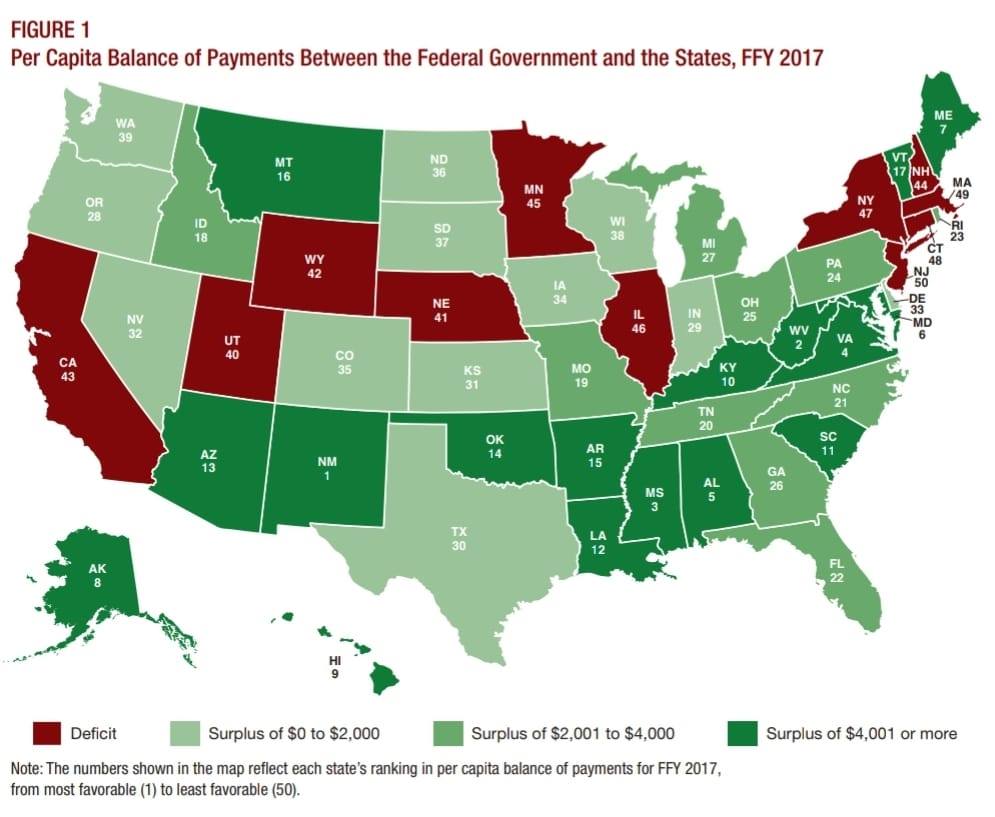

4) The criticism from lawmakers on giving money to state and local governments is that the government is bailing out states that cannot manage their budgets. They love to point to New York and California.

The figure below shows the net money received from the federal government (money paid – money received). States in red give more money in taxes to the government each year per person than they receive and the states in green receive more money than they give. The darker the green, the more money they receive. New York gives almost $1,200 per person to the federal government and California gives around $350 per person to the federal government. The notion that this is bailing out poorly run states is just false and is a bad faith argument made by politicans. The aid to state and local governments will help avoida very slow recovery of those jobs like we saw after the Great Recession and should help lead to a faster economic recovery this time.

5) A $15 minimum wage is important as well to help lower income earners. Evidence of past increases in the minimum wage shows that it reduces income inequality, closes the racial wealth gab, and has a small impact in the number of jobs.

Here are some resources supporting the above statement and more reading on the impact of minimum wage increases:

Minimum Wages and Racial Inequality – Derenoncourt and Montialoux (2020)

The Effect of Minimum Wages of Low-Wage Jobs – Cengiz et al. (2019)

The Contribution of the Minimum Wage to US Wage Inequality over Three Decades – Autor et al. (2016)

City Limits: What do Local-Area Minimum Wages do? – Dube and Lindner (2020)

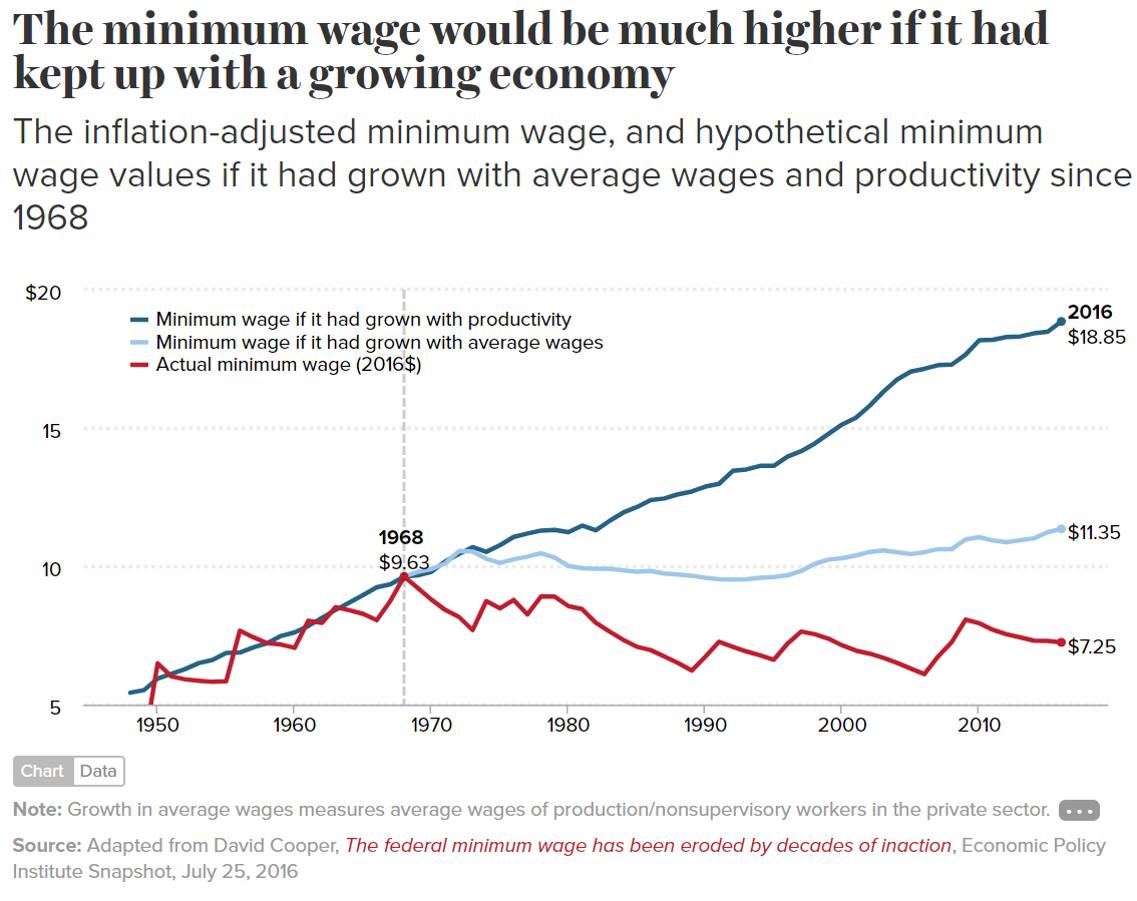

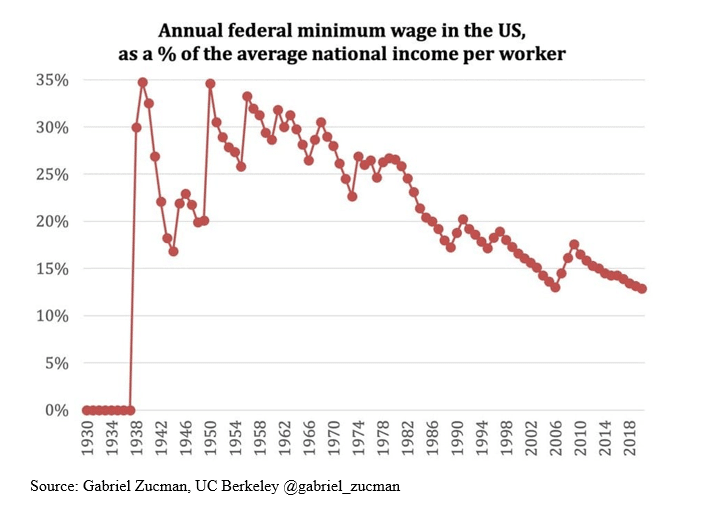

Additionally, the federal minimum wage has failed to keep up with the growing productivity level and the average income in the United States since around 1970. If the minimum wage grew with productivity, then it would be approaching $20. (see attached figure). Additionally, the federal minimum wage as a percent of the average income in the United States has been falling for decades. When it was first introduced in the 1930s, minimum wage was 35% of the average income, now it is under 15%. A $15 minimum wage would be about 25% of the average income, a boost more in line with what we saw up until 1980.

One of the lesson from the economic recovery of the Great Recession was that the investment was too small; this led to a slow recovery that took years. This investment is a good step in the right direction; hopefully Congress acts quickly once Joe Biden takes office.